This survey of industry perceptions of defense conversion in the Los Angeles region followed two years after the bench mark survey of aerospace firms conducted to prepare the “Economic Adjustment Strategy for Defense Reductions.” The purpose was to explore such questions as:

- Are aerospace firms in the greater Los Angeles region becoming less dependent on defense contracts?

- How effective do these firms think government has been in responding to the economic impacts of defense cutbacks?

- What do they think the role of government should be? What programs do they think are needed?

- What degree of collaboration with other firms, government and labor do they think would be useful?

- How clearly have firms been able to anticipate how they would be impacted?

- Do firms have a common vision of how the region’s technological strengths can be applied to new markets?

Given the apparent lack of new jobs created for the region’s unemployed aerospace workers, this survey was designed to investigate the progress and strategies of high technology firms confronting precipitously declining defense sales. Defense conversion programs that bring aerospace technologies into commercial markets must respond to core interests and business strategies of defense-related firms. These businesses are part of an economy in which government programs require consent of the governed and industry participation in defense conversion programs is voluntary. To date, very little attention has been given to understanding what types of industrial growth and diversification strategies will elicit voluntary support and participation of defense-related businesses.

The need for compatibility between public programs and private interests implicit in the need for “consent of the governed,” is particularly applicable to the Los Angeles region, which is a center of identity and industry concentration for aerospace, and yet lacks both tradition and resources for publicly guided industrial development programs. Regional (as well as state and federal) resources to support defense conversion are small compared both to previous defense expenditures and market forces. Highly effective public-private collaboration is required for these modest resources first of all to be harnessed, and secondly to have an appreciable impact.

Seven major findings emerged from the survey:

- From 1991 to 1993, dependence of the region’s aerospace manufacturers on defense funds increased. In 1991, the share of revenue reported by aerospace (aircraft, missiles, electronics, and search and navigation equipment) firms for sales to the Department of Defense was 59%; by 1993 this share increased to 65%. It appears that the decline in civil aircraft sales eroded commercial markets at an even faster rate than military sales declined, and that defense conversion efforts have not opened significant new markets for the region’s major defense contractors.

- Businesses view defense conversion as important for Southern California’s future. When asked how important it is for Southern California’s economic future that defense-related industries diversify into new commercial markets, 84% responded either that it is important or critically important.

- Businesses are overwhelmingly critical of efforts by every level of government to respond to defense cutbacks. When asked to rate the effectiveness of federal, state, county and city government in responding to the economic impacts of defense cutbacks, 88% rated every level of government as ineffective.

- Two well defined “cultural” groups can be identified in the high technology business community, based on willingness to collaborate with government and other firms. One group made-up of about one-quarter of firms has a consistently positive view about cooperation with other firms and government. A second group of about one-fifth of firms has consistently negative views about possible business strategies of regional collaboration. A majority of firms lie midway between these positions, indicating interest in obtaining public sector support through a regional industrial development strategy, but is at best luke-warm about collaborating with government and only slightly more interested in collaborating with other firms.

- What high technology firms say they need most is a stable regulatory environment, availability of financing, and information about new markets. When given a menu of thirteen possible programs and asked how much value each would have in helping high technology firms deal with defense cutbacks and become successful in new markets, the top four choices call for government help in a hands-off role:

- reliable assurances about future regulatory requirements

- loans for product development, re-tooling, or expansion

- information about product requirements for new markets

- high risk capital for promising new businesses

- Businesses indicate the greatest interest in strategies calling for independent growth and diversification. When given a menu of fourteen possible business strategies and asked how much value each would have in helping their firms grow and remain strong, the top three choices emphasize “going-it-alone” rather than cooperating with other firms:

- increasing your firm’s share of its primary market

- new product development

- new markets for existing products

- Firms are optimistic about their futures, but have been wrong two-thirds of the time when predicting their own growth or decline. Only one-in-four indicate they expect employment in their own firms to decline over the next five years, yet two-out-of-three indicate that they expect aggregate employment in Southern California’s high technology sector to decline. Optimism of firms for their own futures is clouded by a longitudinal comparison of firm’s previous projections to actual employment outcomes. Businesses have been wrong 67% of the time when projecting whether their employment would grow, remain stable or decrease. A tendency to err on the side of optimism is reflected in that 43% of firms have indicated their employment would grow, and been wrong 74% of the time; 36% have indicated their employment would remain stable, and been wrong 94% of the time; and 21% have said their employment would decline, and been right 100% of the time.

Chapter Headings:

- Overview of Major Findings

- Survey Responses from 358 defense-related firms in the 5-county Los Angeles region

- Cooperation

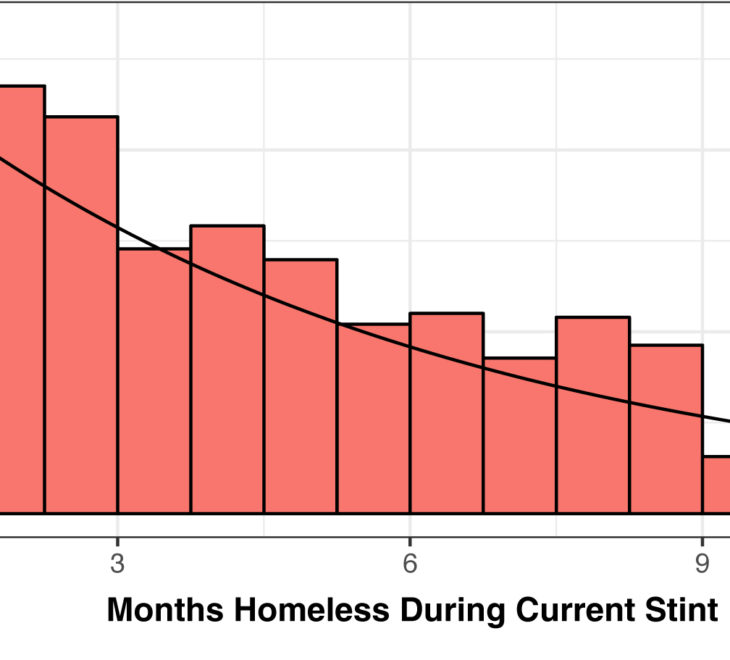

- High Technology Job Creation

- Recommendations

- Methodology.