Long Beach has completed four annual cycles of surveying firms in the City to assess business conditions and needs. A total of 1,532 firms have responded to surveys over the four years and of these, 497 firms have received site visits in which additional information was obtained and referrals made for follow-up City services. With the large survey database that has been created it is now possible to identify long-term trends in Long Beach’s business environment as well as make detailed assessments of conditions in specific industries.

Improved Perceptions of Business Environment

Assessments of the Long Beach business environment have improved markedly from 1994 to 1997. A growing majority of firms say that Long Beach is a positive location for business and that they would make the same choice of a business location again today. There has also been is a dramatic decline in the number of firms reporting problems. Trends in all key areas of the business environment are positive. Improvements include:

- 6% more firms say they would still locate in Long Beach

- 3% more firms say Long Beach is a positive location for business

- 9% fewer firms say they laid-off workers in the past year

- 7% fewer firms report difficulty finding qualified workers

- 6% fewer firms say they are undecided about renewing their lease

- 15% fewer firms report worsening security problems

- 1% fewer firms report physical barriers to expanding their facility

- .2% fewer firms say they may relocate outside Long Beach

- 23% fewer firms report major customers and suppliers have relocated

- 21% fewer firms report that their industry in recession

- 18% fewer firms report that sales decreased in the past three years

- 1% more firms report that sales increased in the past three years

Strengths

The business community continues to identify Long Beach’s central location and transportation infrastructure as highly valuable assets.

- Central location is Long Beach’s most frequently identified strength, mentioned most often by transportation-linked and finance-insurance-real estate businesses.

- Access to a large customer base is the second most frequently identified strength, mentioned most often by retail businesses.

- Port facilities are the third most frequently identified strength, mentioned most often by transportation and wholesale businesses.

- Freeways are the fourth most frequently identified strength, mentioned most often by wholesale businesses.

Weaknesses

Public safety and crime are the most frequently identified problems, followed by blight and business license fees.

- Public safety in general as well as crimes against property and people are the most frequently identified problems, ranking first, second and third in terms of weaknesses cited in the business environment (later graphs show that perceptions of this problem have improved significantly since 1994).

- Blight and deterioration are the next most frequently identified problem, mentioned most often by businesses in the finance, insurance and real estate sector.

- Business license fees are the fifth most frequently identified problem, mentioned most often by service and retail businesses.

Calls for Action

Actions recommended by companies to improve the business environment are more wide ranging than either the strengths or weaknesses they identify. Top ranking recommendations include:

- Improving general public safety, mentioned most often by transportation-linked and service businesses.

- Increased City support for business, mentioned most often by transportation-linked and wholesale businesses.

- Increased police availability, mentioned most often by retail and wholesale businesses.

- Increased efforts to recruit new businesses, mentioned most often by finance, insurance and real estate firms.

- Eliminating blight and deterioration, mentioned most often by finance-insurance-real estate and wholesale businesses.

- Upgrading the built environment, mentioned most often by manufacturing and service businesses.

- Reducing business license fees, mentioned most often by service and manufacturing businesses.

Summary of Survey Responses

A roll-up of answers from all 1,532 firms responding to the mail survey from 1994 through 1997 is shows that plans to expand sales and employment, as well as the assessment that Long Beach is a positive location for business rank high in the overall profile of responses. Problematic business conditions are reflected by a significant minority of firms reporting that sales have decreased and that their industry is in recession.

Defense Cutbacks and Industrial Restructuring

Long Beach’s business outreach surveys were initiated in 1994 as part of a determined City effort to retain employers and strengthen the business environment. These surveys are unusual in that they ask tough, bottom-line questions that sometimes elicit candid expressions of frustration and discouragement from businesses.

The surveys began in 1994 as Long Beach was feeling the brunt of national and global forces that have restructured the City’s industrial base, including:

- the long-lasting 1990 recession

- loss of nearly two-thirds of the jobs at the huge McDonnell Douglas aircraft plant

- loss of the naval base

- closure of the shipyard

The four years of survey data chart the first milestones in a remarkable economic recovery from these massive adverse impacts to the City’s employment base. The first year of survey data found many firms struggling to survive. Over the following three years the bad news has stopped getting worse and key business indicators have moved strongly in a positive direction.

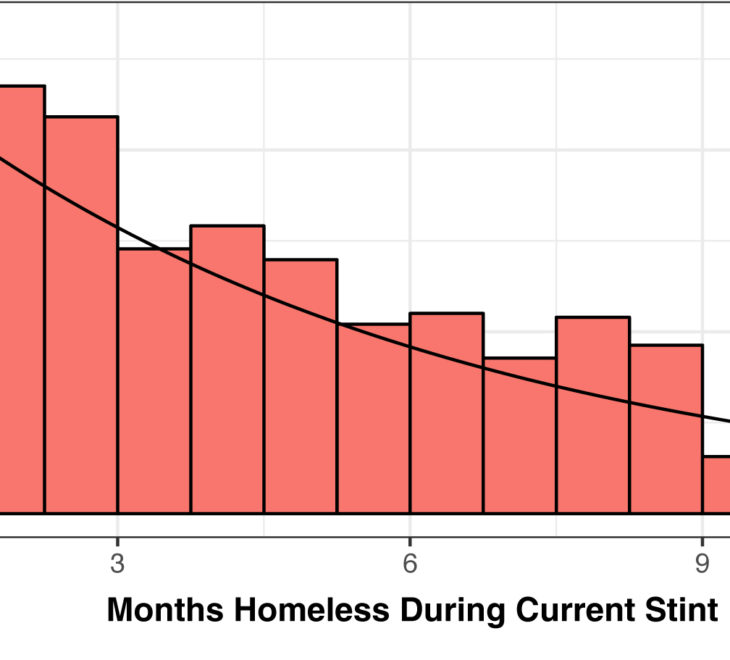

Employment and Unemployment Among Long Beach Residents

An analysis of unemployed Long Beach residents in each occupational grouping from July 1994 through June 1996 shows those at the bottom of the skill ladder accounting for the largest share of unemployment. This includes those in secretarial and office occupations, helpers and laborers, and cleaning and building service workers. These occupations account for a significantly higher share of the City’s unemployed workers than of its employed workers. This profile of unemployment in Long Beach suggests a need to “bring up the bottom” to ensure that all residents have sufficient skills to find a place in the City’s emerging economy.

The ratio of employed to unemployed workers is much more positive in higher skilled occupations. Long Beach has a significant number of residents employed in executive, administrative, managerial, precision production, engineering, educational, and health occupations. Each of these higher skilled occupations have high levels of employment and low levels of unemployment.

Minority, Home-Based and Woman-Owned Businesses

The 1997 survey included questions that allowed firms to identify whether they are minority-owned, woman-owned and/or home based. Of the 279 firms responding the mail survey, 113 firms met one or more of these criteria.

The small number of firms in each of these groups makes it important to interpret the responses cautiously. Findings suggested by these responses, that can be verified as the sample grows with subsequent surveys include:

- The percent of businesses in these groups planning to expand employment is lower than for Long Beach businesses in general.

- Woman-owned businesses are more cautious than others in announcing plans to expand employment, sales, buildings, equipment, or products and services.

- The percent of these businesses indicating that sales increased in the past three years is lower than for Long Beach businesses in general.

- The percent of woman-owned businesses indicating increased sales was low, and the percent indicating decreased sales high, compared to other businesses.

- The percent of these businesses indicating their industry is in recession or that major customers and suppliers have left the area appears to be lower than for Long Beach businesses in general.

- The percent of these businesses reporting that they laid off workers in the past year is lower than for Long Beach businesses in general.

- The percent indicating that Long Beach is a positive location for business and that they would still choose it as a business location appears to be similar to that of Long Beach businesses in general.

- The percent of businesses in these groups interested in meeting with the City to work on business problems is higher than for Long Beach businesses in general.

Chapter Headings:

- Overview

- Improved Perceptions of Business Environment

- Strengths

- Weaknesses

- Calls for Action

- Economic Context of Surveys

- Defense Cutbacks and Industrial Restructuring

- Impacts felt Most Strongly in Long Beach

- Employment and Unemployment Among Long Beach Residents

- Analysis of Key Business Indicators

- Analysis of Major Industry Sectors

- Feed-Back from On-Site Visits

- City Follow-Up