Los Angeles is considering a raise of the citywide minimum wage.

We recently coauthored at report Los Angeles Rising: A City That Works for Everyone with the UCLA Labor Center and Institute for Research on Labor and Employment which looked at the consequences, both intended and unintended, of such a lift. We found that a phased-in increase to $15.25 by 2019 will put $5.9 billion more into the pockets of 723,000 working people, which will generate $6.4 billion in increased sales. That means that every dollar increase in the minimum wage generates $1.12 in economic stimulus. Businesses will hire more in response to the greater demand, creating 46,400 new jobs.

Why is a $15.25 raise such an economic boost for the local economy?

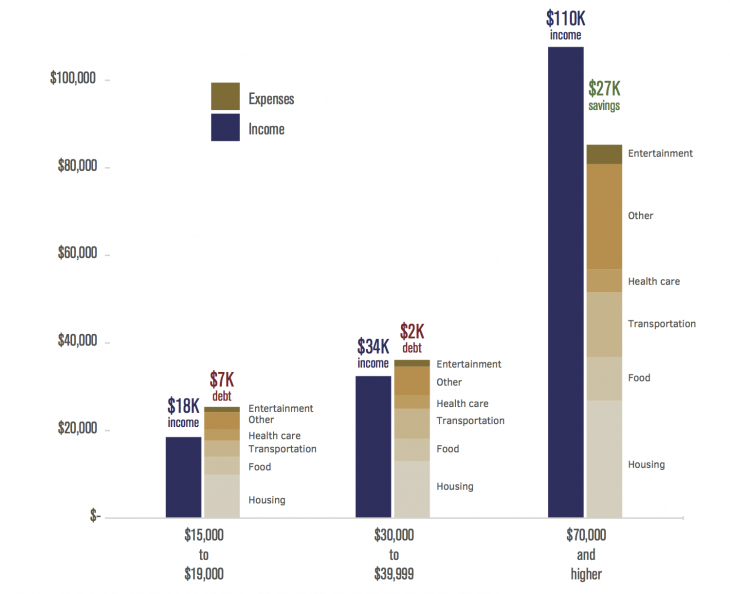

The answer, we found, lies in the household spending patterns of families who earn minimum wages. Families who earn less than $40,000 a year typically spend their earnings as soon as they are paid on basic needs. On average, a U.S. household that earns $34,000 spends about $36,000 on living expenses (see figure below). The wages earned by low- and moderate-income workers, therefore, go quickly back into circulation after pay day. The direct beneficiaries are place-based businesses, that cater to households within the immediate geographic vicinity. This includes real estate, health care, restaurants, and retail stores. These local businesses will reap increased sales, which allows them to grow and expand the economy.

In contrast, high-income households who bring home $70,000 or more a year, which includes most shareholders of corporations that employ minimum wage workers, set aside almost a quarter of their earnings, an average of $25,630 a year, in savings. Most of this money is placed into investments that are far removed from Los Angeles.

Therefore, a raise to $15.25 by 2019 is an investment in Los Angeles. Minimum wage workers will spend increased earnings of $5.9 billion in the local economy that will help the city grow.