SYNOPSIS

This report studies the impact of defense restructuring in Southeast Los Angeles County and makes recommendations for economic development. Southeast Los Angeles has been the manufacturing core of the Los Angeles region since the 1920s. The subregion suffered the collapse of heavy manufacturing industries such as automobiles, steel, and tires in the 1970s and early 1980s, and is now enduring severe job loss in the restructuring defense sector. Southeast Los Angeles faces immense challenges in overcoming the effects of industrial decline and creating high-quality jobs for its residents.

Summary of Findings About Industry Job Trends.

Trends in Los Angeles County’s manufacturing employment have been determined by trends in aerospace employment. Between 1977 and 1994, employment in the non-durable manufacturing industries was relatively stable, as declines in some industries were offset by gains in other industries (e.g., apparel). In contrast to this stability, employment change in the durable manufacturing industries followed employment change in aerospace. In 1992, the aerospace industry employed 22 percent of the county’s manufacturing workers; and 38 percent of the workers in durable manufacturing industries.2. The decline of employment in aerospace and other durable manufacturing industries has contributed to increased polarization of jobs and incomes in Los Angeles County. In the manufacturing sector, this trend is highlighted by the emergence of the low-wage Apparel and Textiles industry. In the non-manufacturing sectors, this trend is seen in the importance of both high-wage industries such as Health Services, Motion Pictures, and Finance and low-wage industries such as Eating and Drinking Places, Business Services, and Wholesale and Retail Trade.

The most salient fact about SELAC’s employment structure is the importance of manufacturing. In 1992, manufacturing industries employed 263,900 workers in the SELAC subregion. This was 37 percent of the county’s manufacturing employment, and 29 percent of total employment in Southeast Los Angeles County.

Aerospace firms in the SELAC subregion employed 54,900 workers in 1992, or 35 percent of total county employment in aerospace.

Communities in Southeast Los Angeles County have been especially hard-hit by the decline of aerospace and durable manufacturing industries, due to the relatively high concentration of employment in defense-linked industries.

Summary of Findings About Laid-Off Workers and Retraining Needs

1. Twenty-nine percent of Los Angeles County’s displaced aerospace workers reside in SELAC communities, making it the most severely impacted region of the county.

2. SELAC residents are especially concentrated in machine operator and precision production occupations. Workers displaced from these occupations face wage deflation of as much as 50% when seeking to transfer their skills to related jobs outside aerospace.

3. Minorities make up nearly two-thirds of laid-off aerospace workers œ loss of these jobs is a multiethnic issue, having serious adverse impacts on all groups.

4. Half of laid-off aerospace workers have only a high school degree and one-fifth are not high school graduates. Specific vocational training received on the job, a 10% to 20% salary differential typically paid by defense employers, and employee benefits equalling 49% of salary have enabled these workers to achieve a level of productivity and standard of living that is extremely difficult for them to replicate outside the durable manufacturing sector.

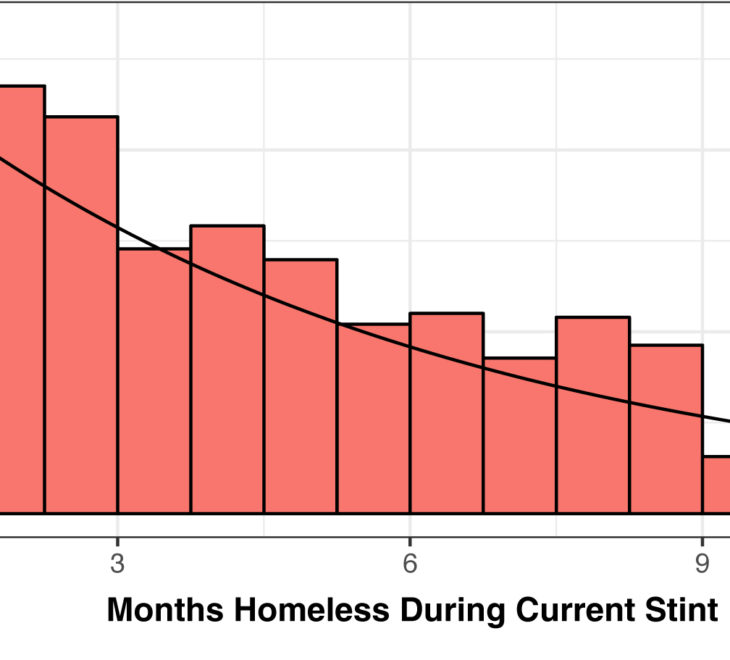

5. Laid-off aerospace workers are typically mature adults with deep roots in the community, making it difficult to relocate and begin a new career. Forty percent are 45 years of age or older, and another 42% are between 31 and 44 years of age.

6. In fiscal year 1994-95 there were roughly 3 laid-off aerospace workers for every job opening utilizing aerospace-linked skills. Overall, job openings were scarcest for the most skilled workers: over 4 mechanics, first-line supervisors and natural scientists for every job opening, and 5 engineers and 6 managers for every opening.

7. The average wage for job openings in aerospace-linked occupations in Los Angeles County is $8.15 per hour, less than one-third the average annual aerospace salary of $48,900. Many manufacturing jobs now available in the region are in the nondurable sector (e.g., apparel, plastic products) where value-added-per-worker is much lower than in aerospace. For example, assembler jobs that are available typically pay $5 to $6 per hour, compared to $12 to $14 per hour in aerospace.

8. Existing training programs were designed to help workers in a growing economy reconnect with employers in the same industry that previously employed them. These programs are poorly suited for helping workers make fundamental career changes to qualify for new occupations in different industries, or for incentivizing employers to hire workers needing extensive retraining.

Summary of Findings About Aerospace/Defense Subcontractor Business Conditions

1. The current-year value of publicly disclosed defense contracts awarded to firms in the county declined only 18 percent between 1987 and 1994, but increased labor productivity further reduced this by 22 percent, and inflation reduced it by another 19 percent.

2. The B-2 Advanced Technology Bomber and the C-17 Cargo Aircraft accounted for 59 percent of DoD revenue for Los Angeles County in 1994, but when these programs end, the county’s once dominant military aircraft industry may no longer exist.

3. The number of firms in the county receiving DoD prime contracts awards declined from a high of 1,557 in 1987 to 939 in 1994. This 40 percent decrease means that more than 600 local firms stopped receiving defense business during those seven years.

4. Defense funding is highly concentrated. The share received by the ten largest contractors increased from 73 percent in 1987 to 88 percent in 1994. The County’s top three firms (McDonnell Douglas, Northrop Grumman, and Hughes) now account for nearly two thirds of DoD revenue.

5. The missile industry is gone from Los Angeles County. Hughes purchased and moved existing production programs to Tucson, Northrop Grumman’s development programs were canceled, and no local prime contractor is part of the new JASSM program.

6. The value of secret programs in Los Angeles County declined from an estimated 50% of publicly disclosed funding for high technology defense programs (or $5.4 billion) in 1987 to 35% of reported high technology programs (or $3.4 billion) in 1994, accounting for an estimated 38 percent of the county’s overall decline in defense revenue.

7. Los Angeles County is losing jobs because a disproportionate amount of local defense funds are subcontracted to other regions. If the county captured all of the jobs created by contracts awarded to facilities within the county, as many as 12,882 more aerospace workers might have been employed in 1994.

8. The highest priority need high technology firms have for the public sector is to provide reliable assurances about future regulatory requirements.

9. Eighty-four percent of high technology firms say it is important for Southern California’s economic future that defense-related industries diversify into new commercial markets, and 71 percent say a regional industrial development policy is needed.

Chapter Headings:

- Executive Summary

- Overview of Trends in Los Angeles County Defense Revenue

- Prime Contractors, Subcontractors, Award Locations

- Long-Term Trends in Defense Procurement

- Revenue from Secret Defense Projects

- Capturing More Benefits from Locally-Awarded Defense Contracts

- Subcontractor Priorities and Opportunities

- Industry Job Trends in Los Angeles County Subregions

- Overview of Job Loss

- Critical Trends

- Overview of Work Force Issues

- Aerospace Occupations

- Geography of Aerospace Lay-Offs

- Profile of Laid-Off Aerospace Workers

- Jobs Available in Aerospace-Linked Occupations

- Work Force Restructuring in Aerospace Industries

- Worker Retraining

- Conclusions and Recommendations.