FOR IMMEDIATE RELEASE: Tuesday, January 12, 2021

CONTACT: Daniel Flaming, danflaming@economicrt.org, 213-892-8104

Anthony Orlando, anthony.w.orlando@gmail.com, 909-869-2408

Unemployment in the Pandemic Recession centers on low-wage, part-time jobs and is projected to cause twice as much homelessness as the 2008 Recession

LOS ANGELES – COVID-driven loss of jobs and employment income will cause the number of homeless workers to increase each year through 2023. Without large-scale, government employment programs the Pandemic Recession is projected to cause twice as much homelessness as the 2008 Great Recession.

In a new report titled Locked Out – Unemployment and Homelessness in the Covid Economy, the Economic Roundtable uses data from the 2008 Great Recession to estimate the linkage between job loss and homelessness. This linkage is used to project the amount and type of pandemic-driven homelessness that will be seen in Los Angeles, California and the United States.

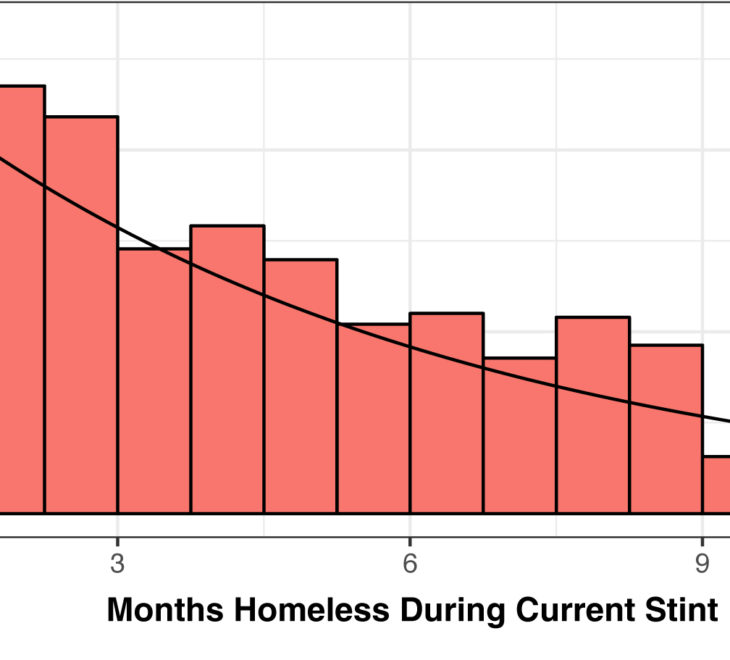

Ten percent of recession-caused unemployment in Los Angeles from the 2008 Great Recession was linked to subsequent homelessness of some type among working-age adults, the report says. Those lacking shelter include: homeless on the streets, shelter residents and couch surfers. Homelessness lagged unemployment at the beginning of the 2008 recession but continued to grow rapidly for three years after the official end of the recession.

Over the next four years the current Pandemic Recession is projected to cause chronic homelessness to increase 49 percent in the United States, 68 percent in California and 86 percent in Los Angeles County.

Homelessness among working-age adults caused by the current recession is projected to peak in 2023, adding 603,000 working-age adults to those already without a place of their own to sleep in the United States. California is projected to be home to 131,400 of those additional homeless adults, with 52,300 in Los Angeles County swelling current homeless numbers.

People are likely to fend off homelessness as long as possible by foregoing other expenses, relinquishing assets and going into debt in order to remain housed. However, without money to pay for rent or the help of family and friends, it is likely that individuals will be evicted and lack a place of their own to sleep. Thus the total number of homeless will continue to grow even after the recession ends.

Most homelessness from the Pandemic Recession is projected to be in the form of couch surfing – 85 percent in the United States, 73 percent in California and 64 percent in Los Angeles County. These different rates result from different propensities to produce homelessness and different mixes in the types of homelessness in different parts of the United States.

The one-fifth of American workers who face the highest risk of long-term unemployment and homelessness earn less than the poverty threshold. Most hold part-time, low-wage jobs, including some workers who are still working but homeless.

Workers who earn poverty-level wages are primarily employed in retail stores, restaurants, schools and universities, entertainment, and social assistance. These are also the industries that have been hardest hit by the current recession.

Workers with the greatest risk of long-term unemployment and homelessness include African Americans, Latinos, young adults 18 to 24 years of age, women, and those with less than a four-year college degree.

The odds of homelessness at any income level are twice as high for Latinos as they are for European Americans, and three times higher for African Americans. Because incomes skew lower for African Americans and Latinos than for European Americans, their risks are compounded. The report says this reflects social hazards experienced by African Americans and Latinos including bias, discrimination and barriers in employment, housing, education, and the justice system.

“Work provides dignity and homeless workers have skills that can benefit the public through employment programs,” said Daniel Flaming, Economic Roundtable President. “The solution of employment costs less than the problem of homelessness.”

Swift and massive government intervention is recommended in the report to create jobs and provide earned income for unemployed workers who face the possibility of homelessness. The report also calls on universities, social services agencies and churches that are employing homeless workers but not lifting them out of poverty to provide higher wages and more hours of work.

One promising pilot effort that demonstrates a new employment model for homeless workers, The Realization Project, is described in the report. The project addresses chronic homelessness as a problem of racial injustice as well as of inadequate income. Participating community college students, who are likely to be persistently homeless, are provided comprehensive life skill services, college-level work-skill development and jobs.

“We emphasize emotional healing and building self-esteem as well as housing and stronger work skills for rising out of homelessness into viable employment,” said Seth Pickens, Project Director.

Housing prices and rents have grown faster than incomes, so housing costs consume an increasing portion of workers’ budgets. Unpaid rent could double by early 2021, straining landlord budgets and increasing pressure to evict delinquent tenants.

Housing is hard to afford for most families in poverty. Over half of U.S. families who are in poverty pay over half of their income for housing. In California almost three-quarters of poverty families are this cost-burdened for housing.

The most important determinant of pending eviction or foreclosure is recent household job loss. Half of Africans Americans and Latinos in the U.S. express no confidence or only slight confidence that they can pay for housing next month. One-third of African-American and Latino renters are behind on rent and expecting eviction.

“Most Americans want to meet their financial obligations,” said Anthony Orlando, Assistant Professor of Real Estate at California State Polytechnic University, Pomona. “Government should give financial incentives to landlords and banks to defer rent and mortgage payments and forgive payments that were missed during the pandemic.”

To increase the supply of affordable housing the report recommends that the federal government should fully fund rent subsidies for low-income families and increase subsidies for building affordable housing. State and local governments should establish affordable housing trust funds and use some of this money to buy empty commercial buildings and convert them to affordable housing.

About the Economic Roundtable

The Economic Roundtable is a nonprofit urban research organization based in Los Angeles that carries out large-scale data analyses to identify practical solutions to social, economic and environmental problems. To learn more, please visit http://economicrt.org/.

###