Photo by Dave Dugdale

Restaurants want an exemption from a minimum wage increase for workers receiving tips, reported Emily Alpert Reyes for the LA Times. Their reasoning is that workers who earn tips already make above the proposed $13.25 and $15.25 an hour. “We treat our workers like family,” one restaurant owner, who declined to be named, told me at the minimum wage public hearing in Watts. “Our workers make more than $15 an hour, they make $19 or even more, both front and back of the house.” He pointed to the sticker on his shirt, “Make Tips Count.”

But, evidence tips us towards a different story. We know that restaurant workers are more likely to live in poverty than the general working population. In our report Los Angeles Rising, we calculated that a quarter lives below the poverty line. This is based on wages that includes tipped income. As a result, families get by with the help of public programs. About 15 percent of employees working in restaurants and bars rely on food stamps and subsidized health insurance (Medi-Cal) to survive. A recent report released by the Restaurant Opportunities Centers United calculated the national cost to taxpayers of over $9 billion a year.

The poverty wages earned by those employed in eating and drinking places is exacerbated by wage theft, when employers don’t abide by wage and hour standards. Wage theft can take many forms; from workers not paid for cleaning up at the end of a shift to not receiving meal or rest breaks. The restaurant industry is rife with wage theft. The Department of Labor conducted investigations of 1,800 restaurants in the west coast and found 72 percent guilty of wage theft. In Los Angeles, approximately one out of every five restaurant workers is a victim of unpaid wages.

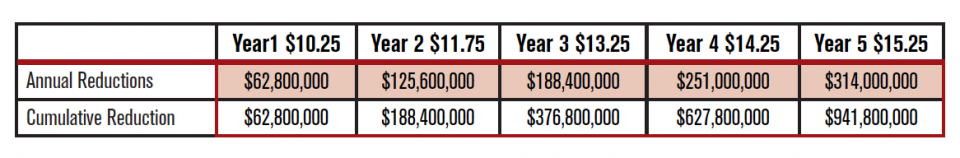

A $15.25 minimum wage with strong enforcement provisions for the 113,776 restaurant workers in Los Angeles can tip the scales towards a more sustainable city. We estimate that a raise in the minimum wage to $15.25 would affect 71 percent of restaurant workers in the city. Not only would families supported by a restaurant employee have more money to spend on basic needs, we taxpayers would not absorb the costs of the industry’s poverty-level wages. Across the economy, a raise would save our city an annual $314 million in public assistance payments, a cumulative benefit of $941 million if phased-in over five years (see Table 1).

Table 1: Estimated Savings in Public Assistance Programs

To us, saving $941 million for taxpayers is the tipping point to include restaurant workers in a $15.25 raise.