The Linkage between New Development and Affordable Housing Demand

New development solves housing problems for some workers by creating new jobs that pay sustaining wages. At the same time, it creates additional demand for affordable housing because some of the workers who will be employed will not earn enough money to afford market-rate rental housing.

In 2010, the City’s Housing Department and Community Redevelopment Agency provided over 53,000 units of affordable housing and there were over 530,000 households that needed affordable housing, leaving over 475,000 low-income households without housing they could afford. In the absence of additional resources to build affordable housing, this gap is projected to grow to 493,000 households by 2020.

This report analyzes a possible affordable housing benefit fee for new development in Los Angeles. If approved, this fee would recover a portion of the public cost for meeting the demand for affordable housing that results from new development. An affordable housing benefit fee is subject to California’s Mitigation Fee Act, which requires: 1) that the purpose of the fee be identified; 2) the use of the fee be identified; 3) a reasonable relationship between the fee’s use and the type of development project on which the fee is imposed be determined; and 4) a reasonable relationship be established between the amount of the fee and the cost of the public facility (i.e., affordable housing) attributable to the development on which the fee is imposed.

The nexus between property development and demand for affordable housing is the deficit between the mean rent for an apartment in the City and the amount of earned income that workers who fill jobs created by these developments can pay for rent without becoming rent burdened. Workers are considered rent-burdened when they pay more than 30 percent of their household’s earned income for rent. Residential rental costs, rather than residential construction costs for new housing, are used because the results are more conservative and stable. The nexus provides the basis for identifying development categories and determining the housing benefit fee level for each category.

Households of workers living in Los Angeles with incomes that are 80 percent or less of the Area Median Income (AMI) typically cannot afford market-rate rent with only 30 percent of their earned income, and thus have an earned income deficit. The mean annual earned income deficits for worker households in the three lowest AMI bands are:

- $10,455 for extremely-low income households (0 to 30 percent of AMI)

- $5,994 for very-low income households (31 percent to 50 percent of AMI)

- $1,235 for low-income (51 to 80 percent of AMI)

The process used by the City of Los Angeles to classify building permits makes it possible to differentiate 29 development categories for different types of buildings that will house different types of industries. Every industry has some workers whose earnings put them into one of the three lowest AMI bands, ranging from 11 percent of utility workers to 67 percent of restaurant workers. Citywide, the average for all development categories is 45 percent. The earnings distribution among workers in each development category enables us to estimate the mean earned income deficit for the labor force in that sector.

Two adjustment factors were taken into consideration before converting the mean annual earned income deficit per worker into a deficit per square foot. First, the demand for affordable housing is based on households and not on individual workers. There is an average of 1.6 workers per worker household in the City, which means that a worker requiring affordable housing typically must pay only 62.5 percent of the cost for a housing unit. Second, the life span of a building determines the total housing impact per worker. Based on Internal Revenue Service depreciation schedules this life span is 39 years for commercial buildings and 27.5 years for residential buildings.

Businesses in the City of Los Angeles occupy an average of 746 square feet of improved building space per job, with this amount varying from 233 square feet for gas service stations to 1,871 square feet for utilities. When the income deficit is projected over the life of buildings, we get the earned income deficit per square foot of new development. The average deficit for commercial development is $69 per square foot, although it varies widely among different types of development. Examples of the deficit per square foot include:

- Renter-occupied apartments $7

- Owner-occupied condominiums $10

- Office buildings $38

- Hotels $46

- Hospitals $63

- Restaurants $274

- Gas service stations $369

New residential development also creates jobs as a result of household consumption, and some of these jobs do not pay enough for workers to afford housing. Residential development generates less demand for affordable housing than commercial development on a square foot basis, but the overall volume of market-rate housing development in Los Angeles makes it a significant contributor to the demand for affordable housing.

Fees, Policy Options and Best Practices

In practice, a linkage fee ordinance would apply to new construction and existing properties that increase building floor area, but not to the rehabilitation of existing properties as long as the land use and pre- and post-rehab square footage remain the same. The linkage fee would apply when new building floor area is permitted that generates affordable housing demand.

The potential impacts of an affordable housing benefit fee may be borne by landowners, developers, investors, or end users, depending on whether a development is sold to an investor or held by the developer, and whether market conditions will allow the fees to be passed on to end users. However, the impacts are relatively low in almost all scenarios because the potential affordable housing benefit fee comprises a small portion of total development costs in every category.

Only 4 percent of the property sales in the City involve vacant parcels, but in those cases, it is most likely that the impact of affordable housing benefit fees would be absorbed by landowners who would experience a diminution in the prices that developers and investors would be willing to pay for their properties. This dynamic is less likely to occur when the current use of land approaches the value of potential new uses, for example, when the density of development on a property approaches the maximum permissible density. Other actors in the development process will absorb the fees to the extent that their profit margins can withstand the additional cost of the fee or that all comparable sites also require absorption of this cost.

It is difficult to identify the tipping point for affordable housing benefit fees that will make development infeasible. This is due to project-by-project variability in financing, land and building costs, market vacancy, rent, profit margins, threshold rates of return, and developer financial capacity. However, the impact of a hypothetical affordable housing benefit fee can be measured in terms of the ratio of fee to development cost. This study establishes a benchmark for the tipping point – the point at which development is potentially deterred by the housing benefit fee – at five percent of development cost.

As such, the potential tipping point for a housing benefit fee ranges from $8.50 per square foot to more than $80 per square foot, depending on the development category. As long as the fee represents a relatively low proportion of total development costs (i.e., up to five percent of total costs), the fee’s impact on development should be nominal. The fee scenarios developed for this analysis range from $1 to $20 per square foot, and these amounts, in turn, range from less than one percent to 11.76 percent of assumed total development costs per square foot. The actual fee range that emerges from analyzing these scenarios is slightly lower than the hypothetical range – $0.32 to $18.09 per square foot. The upper limit of $20 per square foot was used in the scenarios because none of the cities surveyed had fee levels in excess of this amount.

Based on historic development volume in the City of Los Angeles, an affordable housing benefit fee can potentially be a significant revenue source for the Affordable Housing Trust Fund. If a fee had been in place from 1997 to 2007, it could have generated an average of $35 to $110 million a year in revenue, depending on the level of the fee.

A review of fee programs in other jurisdictions identified best practices for optimizing revenue for local housing programs and withstanding legal challenges. These practices include:

- Allow fees to be used for a broad range of affordable housing purposes

- Maximize the potential for generating revenue by applying the fee broadly to many classes of properties

- Be cautious about requiring a geographic link between where fees are generated and where they are spent

- Create a mechanism for periodic adjustments to the fee schedule as market conditions change

- Collect fees at project stages that minimize adverse impacts on developers

- Provide developers with alternatives to paying fees, including donating land and building affordable housing

- themselves.

- Establish criteria for fee exceptions that are clear, objective, and simple to administer

- Enforce compliance with fees through effective administrative measures such as withholding building or occupancy permits for noncompliance

- Provide flexibility in the linkage fee program – to enable fee adjustments or suspend the fee during severe recessions – and enable timely responses by delegating authority to an administrative level of city government to oversee fee adjustments

Benefits of Affordable Housing

Increasing the supply of affordable housing throughout the City can strengthen the jobs-housing balance and lead to mutually beneficial outcomes for low- and moderate-income residents and their employers. The benefits accruing to employers of low- and moderate-income workers include having increased access to workers within a convenient commuting radius to their work site and to workers with longer-term, more stable connections to their homes. This increased residential permanency and predictability means fewer turnovers of workers and greater labor force stability for employers.

Housing that is very difficult for workers to afford and sometimes overcrowded, and work commutes that are time-consuming – sometimes without a large enough mobility radius to reach higher-paying jobs, all increase the likelihood of worker turnover. Workers can find themselves forced to quit their jobs when they are displaced from housing because they cannot afford the rent, when overcrowding results in untenable living conditions, or when time-consuming commutes conflict with family needs.

Stable, affordable housing that workers can afford and that is not overcrowded is a strong incentive to remain in the same place, which is likely to reduce worker turnover. Reduced turnover creates significant cost savings for employers. It costs an estimated 30 percent of a worker’s annual salary to replace that worker. Stable, decent and affordable housing located near workers’ jobs is likely to reduce the frequency of worker turnover and result in significant cost savings for employers.

Transit oriented districts (TODs) provide particularly advantageous sites for affordable housing. These districts comprise the area within a half-mile radius of subway and light-rail stations, affording a comfortable walking distance for accessing public transit. Thirty-two percent of the affordable housing inventory created by the Housing Department and Community Redevelopment Agency is in TODs, as are 18 percent of the City’s rent stabilized units. There are strong arguments for preserving and expanding the affordable housing inventory in TODs.

Los Angeles’ poorest households have fewer cars, making it more difficult for their employed members to get to their jobs. Among Los Angeles households whose incomes are 80 percent or less of the Area Median Income, 20 percent have no vehicle, while another 46 percent have access to just one vehicle. Given that many of the City’s working poor families rely on more than one income earner, and that buying, maintaining and using a private vehicle is expensive, locating affordable housing in TODs where there is ready access to public transit creates efficiencies for these households, reducing the disadvantage of not having access to cars.

Workers who use public transit to commute to their jobs save an estimated $831 per month, or $9,967 per year, in transportation costs tied to automobile use, including operating and workplace parking costs. When the savings from using public transit are combined with the gap between the cost of affordable housing and the cost of market rate housing, the annual value of affordable housing in a TOD is:

- $20,422 for extremely-low income households (0 to 30 percent of AMI)

- $15,961 for very-low income households (31 to 50 percent of AMI)

- $11,202 for low-income households (51 to 80 percent of AMI)

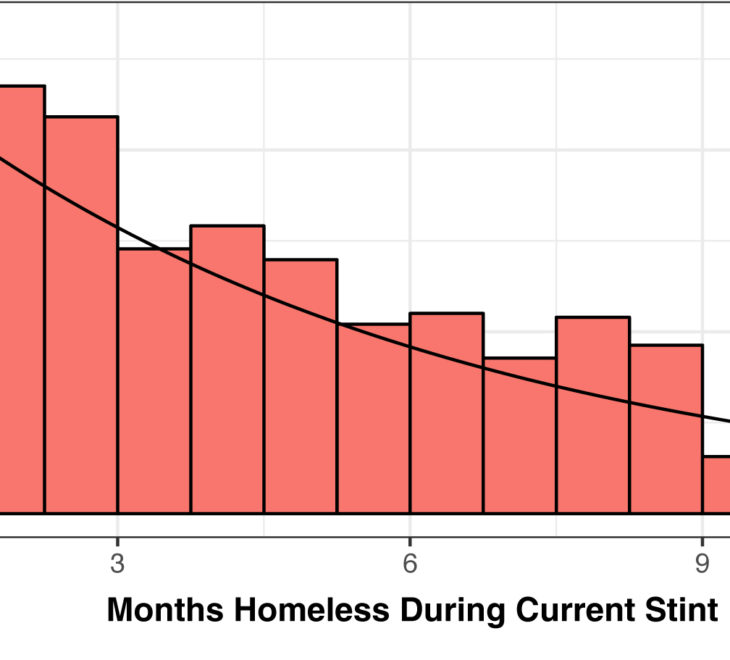

Estimates of Future Demand for Affordable Housing

Population growth and composition will determine the amount and type of affordable housing needed in the next decade. Since 2000, increasing shares of households headed by seniors, people with disabilities and low-income single parents have not been able to secure affordable housing. Currently, only 34 percent of households headed by a senior, 32 percent of households headed by a person with a disability, and 17 percent of households headed by a low-income single parent are able to secure housing with rent they can afford.

The number of households headed by seniors is projected to increase 45 percent over the next decade, compared to 3 percent growth in renter households headed by persons under 65. Nearly 85 percent of all renter households headed by seniors fall in the three lowest AMI bands.

Job growth will lead to population growth and to additional demand for affordable housing. Forty-five percent of new jobs that will be created over the next decade are projected to be in the 3 lowest AMI bands, paying workers insufficient wages to afford rent in the City of Los Angeles. The number of workers in the three lowest AMI bands is projected to increase 11 percent by 2020. In addition, low-income workers who provide the goods and services consumed by occupants of new market rate housing built in the City over the coming decade are projected to need 3,639 units of affordable housing.

In the face of this growing demand for affordable housing, the City is projected to add 33,514 new units of affordable housing by 2020 with existing financial tools, with some of this progress offset by the possible loss of current affordable housing and rent-stabilized units. The City is projected to lose as many as 20,487 affordability-restricted units when the agreements for those units expire, and 3,463 rent-stabilized housing units after they are converted to other uses. This adds up to a projected total of 23,950 housing units lost. The City’s progress towards meeting the large demand for affordable housing will be substantially augmented if additional funding becomes available through an affordable housing benefit fee.

Conclusions and Recommendations

The information analyzed in this study establishes a nexus between property development and demand for affordable housing. The recommended fee levels are proportional to the demand for affordable housing that results from different categories of development, taking into account the tipping point for each category. The recommended affordable housing benefit fees will partially offset the public cost for meeting the additional demand for affordable housing.

If an affordable housing benefit fee is enacted, it will provide a revenue stream to finance construction of additional affordable housing units. Three scenarios, with the fee pegged to different shares of the demand for affordable housing created by new development illustrate the potential contribution of a fee to building affordable housing:

- A fee equal to 5 percent of the demand created by new development (low fee scenario) will finance an estimated 3,760 additional affordable units in the next decade.

- A fee equal to 10 percent of the demand created by new development (medium fee scenario) will finance an estimated 7,521 affordable units in the next decade.

- A fee equal to 15 percent of the demand created by new development (high fee scenario) will finance an estimated 11,281 additional affordable units in the next decade.

These projected impacts of fee revenue on affordable housing production are based on the assumption that the City’s Affordable Housing Trust Fund dollars will be leveraged with loans and grants from Federal and State agencies as well as the capital markets, and that the average Trust Fund investment will be $100,000 per unit.

Since its inception in 2003 through 2007, the Affordable Housing Trust Fund’s annual budget has ranged from $23 million to $119 million. A fee equal to 5 percent of the demand generated by new development will generate approximately $37 million annually, an amount well above the low-end range of the Trust Fund budget. A fee equal to 15 percent of demand generated by new development will add about $112 million annually to the Trust Fund budget, doubling the current production level of affordable housing units. These projected levels of potential revenue are based on an annual average of 24 million square feet of new commercial and market rate residential development in the City over the past decade.

Investment of fee revenue in building affordable housing would create new jobs in the City of Los Angeles. Every one million dollars spent on housing construction would generate 10.6 person years of employment. Depending on the fee level approved by the City, 400 to 1,200 new jobs would be created in a typical year, with actual levels ranging lower and higher depending on the amount of new development.

Information from this study shows that there is an acute demand for affordable housing in the City of Los Angeles and that it is feasible to impose a fee to pay a portion of the public cost for meeting the additional demand for affordable housing that is generated by new development without deterring further new development. Policy decisions for the City of Los Angeles in deciding whether and how to implement an affordable housing benefit fee are summarized below.

- Should a fee be imposed on new development to offset some of the demand for affordable housing that will be generated by that development?

- Should there be a threshold size for development that is subject to the fee? Should small projects, for example, under 10,000 square feet, be excluded?

- What level of fee should be imposed? Should the fee be based on the different tipping point for different types of development? Should the fee be a uniform percent of the earned income deficit for all development categories?

- What is the adjustment mechanism for the fee? Should it be adjusted annually based on an index of construction costs in the Los Angeles region?

There is wide variation in the earned income deficit generated by different types of development, as well as the level of fee that different types of development can afford to pay. This study establishes a clear nexus between property development and demand for affordable housing based on the deficit between the mean rent for an apartment in the City and the amount of earned income that workers who fill jobs created by new development can pay for rent without becoming rent burdened. The fee levels recommended in this study will ensure the feasibility of continued development in the City while also obtaining equitable payments from developers to offset some of the demand for affordable housing generated by new projects.

Time Line of this Study

- Original RFQ (request for qualifications) released: September 12, 2007

- Study begun: August 18, 2009

- Draft report: January 14, 2011

- Final report: June 6, 2011

- Transmitted to Mayor: January 23, 2012

Related Articles

- LA Passing Up Tens of Millions For Infrastructure and Affordable Housing

by Bianca Barragan, Curbed LA, November 5, 2015 - S.F. Voters Approve $310 Million Housing Bond: The proposition will help the city meet its goal of building 30,000 housing units by 2020

By Donna Kimura, Affordable Housing Finance, November 4, 2015 - High Rent, Few Options: A Series of Stories on Renting in Los Angeles. KPCC.org